About Us

Jewel Equity Group is a real estate investment and consulting firm that leverages its extensive experience and expertise to provide superior value and returns to its clients. We have built a large profitable portfolio of multifamily assets across premium locations.

Investors can invest via Savings / Personal liquidity or, Self-Directed IRA, 401K, QRPs etc. or, Cash -out refinance of their primary residence or, HELOC or, 1031 Exchange or, even by taking a Loan against life insurance.

Past Investments

How it Works

Click the + sign to know more

The split can be anywhere from 50/50 to 90/10 between LPs (aka limited partners/passive investors) and GPs (aka Active partners/Operators/Sponsors). This is applicable for cashflow, refinance and sale equity distribution. The most common split observed is 70% to LPs and 30% to GPs.

Simple Returns through Rental Cashflow

Based on the profit split between GPs and LPs all rental cashflow is shared between LPs and GPs. Similarly, when the property is refinanced or sold, all proceeds are split based on the LP / GP Profit Split.

Preferred Returns through Rental Cashflow

If the deal has a preferred return then, the LPs or passive investors will receive a return of up to X% before the GPs are paid. If the asset cash flows less than X%, the LP receives everything (and their preferred return will accrue for next year). If the asset cash flows more than X%, the LP receive their X% preferred return first and, the remaining profits are again split between the LP and GP. At the sale of the property, after the LP receives the remainder of their equity investment (and if applicable, the accrued preferred return that wasn’t paid out yet), the GPs also receive a catch-up distribution based on the profit split.

Refinance or supplemental loan proceeds:

If the GP refinances into a new loan and/or secures a supplemental loan, the LP will typically receive a distribution that is a portion of their initial equity investment. Similar to the profit split, the proceeds from a refinance or supplemental loan are typically considered a return of capital i.e they reduce the LP’s capital account.

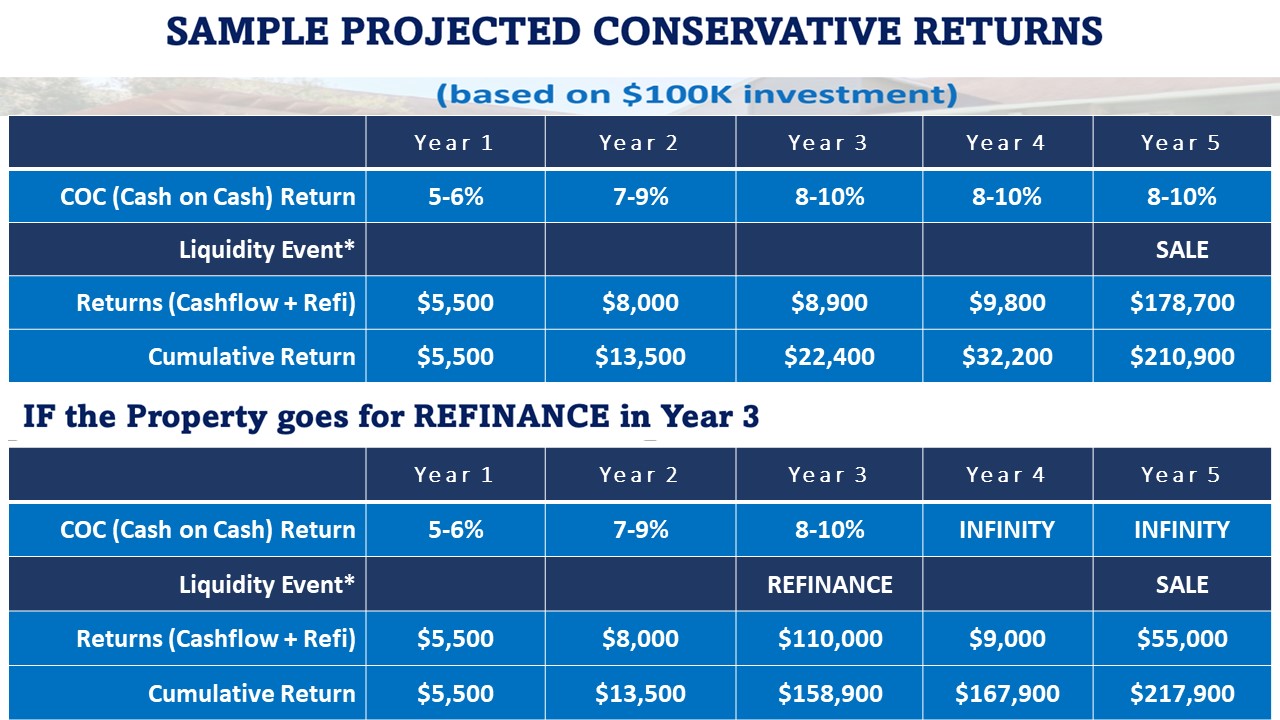

Cash on Cash Return (CoC)

Cash income earned relative to the original cash investment e.g a property generating $10,000 in annual cash flow after debt service and initial cash investment of $100,000, has a 10% cash on cash return. A typical minimum CoC target for syndicated investments is 8-10%. It is not uncommon for the cash-on-cash return to be lower in Yr1-2, while the property is being updated.

Average Annual Return (AAR)

Return on investment averaged over the hold period of the asset, measured as total distribution to members divided by the initial cost of the investment or cash investment. A typical minimum AAR target for syndicated investments is approx. 15%+. It is not uncommon for the average return to be lower in Yr1-2, while the property is being updated and value-add work is ongoing.

Internal Rate of Return (IRR)

This metric captures the full return of the investment including distribution to members (referenced above) coupled with the gain on sale after accounting for time value of money. The timing of when cash flow is returned impacts the IRR. Therefore, the sooner you receive the cash back, i.e. the shorter the hold period, the higher the IRR. A typical minimum IRR target for syndicated investments is 15+ to 20+%.

Equity Multiple (EM)

Measured as total dollars received divided by total dollars invested. Total dollars received includes the cash flow earned throughout the hold period of the asset coupled with the sale proceeds. For example, if you invested $100,000 and you received a total of $200,000 throughout the hold period of the asset including gain on sale, that means you achieved equity multiple of 2.00x or in other words you doubled your initial investment. A typical minimum EM target for syndicated investments is 1.50+ to 2.00+x.

Before

Prospective investors receive an Offering Memorandum which details the property types, markets, and projected returns.

Once you have decided to partner with us, you can register on the investor portal. The link will be sent to you separately.

Investors complete the investment documents and contribute capital.

After

We have monthly investor webinars and, send quarterly investor newsletters outlining the progress of business plan, financials and important updates from the property.

Cash Flow and profit amounts are delivered via wire transfer or ACH to investors linked bank accounts.

You can check live samples of offering memorandum and monthly investor meets HERE .

Cash Flow – Based on your shareholding, the corresponding amount checks are deposited in your account either monthly or quarterly (depending on the distribution process defined for the deal), after all expenses of the property are paid.

Forced Appreciation – Unlike residential, we can force appreciation by value-add strategies in the commercial multifamily property through proven techniques and extensive research of projections before buying.

Tax Benefits – Depreciation is a tax write-off that enables you to keep more of your profits. Passive losses through depreciation are used to write off other passive and capital gains.

Leverage & Amortization – You can get great debt terms up to 60-80% of the property value and paying down debt creates equity leading to long term wealth.

Stability – Multifamily is less volatile and continues to outperform traditional stock-based investments and other asset classes.

Investor Protection –Multifamily syndication offers a secure investment avenue as it operates under SEC regulations, providing transparency, compliance, and investor protection in the dynamic landscape of real estate investments. Leveraging the SEC’s Regulation D, options like 506(b) and 506(c) offerings enhance the credibility and compliance of multifamily syndication, reinforcing a robust and secure investment strategy for our investors.

Meet the Team

Hemant Pawar

Managing Principal

Hemant Pawar is the Managing Principal of Jewel Equity and is owner operator of multi-million dollar commercial properties across USA.

His previous background as an IT Program Director with the largest organizations gave him the necessary skill set to run large scale operations in real estate. He has an investor focused approach and has implemented strong processes around streamlining investor communications and operations.

He runs a private charity organization that has so far adopted 27 human trafficking victims from Africa, Central Asia & Middle east

He has an MBA and Engineering degree and, his interests include travel, health and fitness and spirituality.

Vessi Kapoulian

Consultant - Underwriting

Vessi Kapoulian has a professional background that includes 15 years of commercial lending and 4 years of business management experience. Vessi started her real estate journey in 2017. Today Vessi controls a portfolio of investor real estate properties in Florida, Tennessee, and Georgia

Her commercial lending experience has served her well in developing a conservative and analytical approach in assessing risk and investing prudently in real estate in order to maximize returns. Her business experience has helped develop a solutions-oriented and execution-focused approach, which has served well in asset managing her real estate portfolio.

Vessi has earned a Bachelor degree from the University of Arkansas and an MBA from Northwestern University.

Rod Khleif

Senior Consultant

Rod Khleif is an entrepreneur, educator, real estate investor, business owner, author, mentor, and philanthropist who is passionate about business, life, success, and giving back to people in need.

Rod has personally managed over 5,000+ commercial units helping investors acquire over $4B in commercial assets. As an accomplished entrepreneur, Rod has built several successful multi-million dollar businesses.

Rod is Host of the #1 ranked Real Estate Investing Podcast which has been downloaded more than 12,000,000 times – “The Lifetime Cash Flow Through Real Estate Investing Podcast.”

Rod is the author of “How to Create Lifetime Cash Flow Through Multifamily Properties” widely acclaimed to be an essential asset for aspiring multifamily investors.

Disclaimer* – Any potential investors should not construe Vessi Kapoulian or, Rod Khleif listed as a “senior consultant” to mean they or their team have analyzed or endorsed any particular investment opportunity.

Reviews and Recognition

Join Our Rapidly Growing Community

Invest With Us

Fill Our Investor Form and Schedule a 30 minute meeting for a free consultation on multifamily real estate investments

Talk to Us

Frequently Asked Questions.

A single family home, duplex, triplex and quadraplex are considered residential properties. Anything more than 4 units is considered commercial multifamily.

Here are the key differences –

Valuation:

Residential properties are typically valued using a comparative sales approach with respect to recent sales of similar residential properties in the area.

Commercial Multifamily Properties are often valued using an income approach, specifically the capitalization rate (cap rate) method. The value is determined by the property’s ability to generate rental income. This approach considers the property’s net operating income (NOI), expenses, and prevailing cap rates in the market. Valuation for multifamily properties also considers comparable sales, but it places greater emphasis on the property’s potential rental income and its income-generating capabilities.

Lease Terms and Tenant Quality:

Residential property valuation doesn’t typically consider lease terms and tenant quality to the same extent as commercial properties.

Commercial Multifamily Valuation considers lease terms, tenant quality, and the potential for rent increases in commercial multifamily properties.

Income Potential: Multifamily properties often have higher income potential compared to residential properties because they can generate multiple rental incomes from different units. This can provide a more stable cash flow stream, especially in areas with a high demand for rental housing.

Economies of Scale: Multifamily properties may benefit from economies of scale. This can lead to reduced costs for maintenance, repairs, and other operational expenses, as certain costs can be distributed across multiple units.

Appreciation and Resale Value: While residential properties can appreciate in value, multifamily properties can have higher appreciation potential if they are located in areas with high population growth and strong rental demand. The potential for increased cash flow and property appreciation can make multifamily properties a lucrative investment in the long run.

Market Dynamics:

The residential market can be influenced by factors like school districts, neighborhoods, and individual home features.

Multifamily properties are often influenced by location, local rental market conditions, and the overall economic environment.

Yes. We accept self directed IRA and Solo 401(k) funds. If you don’t have an intermediary who does this, you can contact any of the below entities who will help you to get started on the process.

Equity Trust – https://www.TrustETC.com

Quest IRA – https://www.questtrustcompany.com/

Advanta IRA – https://www.advantaira.com/

A short youtube video on how to use your IRA and 401K account to invest is given below- https://www.youtube.com/results?search_query=how+to+invest+from+401+K+in+syndications

Investors receive profits from the cashflow of the property monthly or, quarterly depending on what the team for each deal decides.

No. Not all deals are SEC 506(C) which are for accredited investors only. We also do 506(B) deals for non-accredited investors. You just have to initiate a discussion with us before investing in a 506B deal. Unless we have spoken before atleast once about your investment interest, you may not be able to invest in 506B.

The following self-accreditation websites give you a free assessment

REAL ESTATE FUNDS | REAL ESTATE SYNDICATIONS |

A real estate fund is a pooled investment vehicle that combines the capital of multiple investors to purchase and manage a diversified portfolio of real estate assets. Investors typically purchase shares or units in the fund which acts as the middle layer with fees. The investors do not have any ownership or involvement | A real estate syndication is a where a sponsor or syndicator pools money from multiple investors to acquire a single property or number of properties. Investors in a real estate syndication often have more direct ownership and involvement in the specific property or project |

The fund manager is responsible for selecting and managing the properties in the portfolio. | Investors in a syndication have direct interest and can choose whether they want to invest or not in that asset. |

Investors in real estate funds have a more passive role. They provide capital to the fund and rely on the expertise of the fund manager to make investment decisions and manage the properties. Their returns are fixed by the funds. There is no way to know which of the properties made what kind of profits. | Investors in a syndication may or may not have a more active role, but may have decision-making influence in the specific property or project they are investing in. The syndicator typically seeks input from investors on key decisions. Investors are aware all the time and directly receive the profits with no upper limit. |

The following videos explain this and more in detail 5 mins – https://youtu.be/tmndGdAyruQ | |

Here’s how a preferred return works in the context of real estate syndications:

1.Investor Priority: The preferred return is a predetermined rate of return, expressed as a percentage of the initial investment (capital contribution) made by the limited partners. This rate is usually set when the syndication agreement is established, and it could range from, for example, 6% to 10% per annum.

2.Payment Hierarchy: When the property or project generates income or profits, the preferred return is paid to the limited partners first, and it is often paid on a cumulative basis. This means that if the project doesn’t generate sufficient profits to cover the preferred return in a given year, the unpaid amount accumulates and must be paid in future years when there are sufficient profits.

3.Sponsor Compensation: After the preferred return has been paid to the limited partners, any remaining profits are typically shared between the limited partners and the general partners or sponsors, often following a predefined profit-sharing ratio (e.g., 80% to limited partners and 20% to general partners).

4.Performance Based rewards: The preferred return is designed to align the interests of limited partners and sponsors. Limited partners receive a predictable return on their investment, which encourages them to invest, while sponsors, who are typically more actively involved in the project, receive their share of profits only after the limited partners have received their preferred returns.

The following videos and links explain this and more in detail

- 3 mins video – https://www.youtube.com/watch?v=LxtIaZUpYLg

- 2 mins read – https://apt-guy.com/understanding-preferred-returns/

Here are some key tax benefits that limited partners in real estate syndications may enjoy:

1.Passive Loss Deductions: Limited partners can often deduct passive losses, such as depreciation and mortgage interest, against their passive income from the syndication. These deductions can reduce their taxable income from the investment.

2.Depreciation Deductions: Real estate investors can benefit from depreciation, a non-cash expense that allows them to write off the cost of the property over time. This depreciation expense can be used to offset taxable income, reducing the investors’ tax liability.

3.Tax-Deferred Capital Gains: When a property within the syndication is sold, limited partners may benefit from tax-deferred capital gains through mechanisms like 1031 exchanges. This allows them to reinvest the proceeds from the sale into another investment property without immediately recognizing capital gains for tax purposes.

4.Passive Activity Loss Rules: Passive investors can use passive activity loss rules to offset income from the real estate syndication with passive losses from other real estate investments or activities. This can help reduce their overall tax liability.

5.Distributions as Return of Capital: When limited partners receive distributions from the syndication, a portion of those distributions may be considered a return of capital, which is typically not taxable. This can help investors access their earnings without triggering immediate tax liability.

6.Investment Interest Deduction: Limited partners may be able to deduct investment interest expenses, such as interest paid on loans used to finance their investment in the syndication. However, there are limitations on this deduction.

7.Qualified Business Income Deduction (QBI): Depending on the structure of the real estate investment, some limited partners may be eligible for the QBI deduction, which provides a potential deduction of up to 20% of qualified business income.

8.Tax Credits: In some cases, real estate investments, particularly those focused on affordable housing or historic preservation, may offer tax credits that can directly reduce an investor’s tax liability.

9.Estate Planning Benefits: Real estate investments can provide estate planning benefits, allowing for the transfer of wealth to heirs with potential estate tax advantages.

It’s important to note that tax laws are complex, and the specific tax benefits available to limited partners in a real estate syndication can vary based on factors such as the syndication structure, the investor’s individual tax situation, and changes in tax laws. Therefore, it’s crucial for limited partners to consult with tax professionals or accountants who are well-versed in real estate investments to understand their specific tax implications and optimize their tax strategy.

The following videos explain this in detail

Yes, but not all syndication deals allow 1031 exchange. You will need to find out before signing up for any deal. Please reach out to us if you have a 1031 exchange. The following videos give you a good idea of what it takes.

1031 INTO a syndication – https://www.youtube.com/watch?v=OE0cYcx0pzA

1031 OUT of a syndication – https://www.youtube.com/watch?v=X3gUq4O7efU

The Capitalization Rate (Cap Rate) is a crucial financial metric used in the valuation of multifamily properties. It helps investors and appraisers determine the property’s value based on its income potential and market conditions. When calculating the cap rate for a multifamily asset, several key factors and considerations are taken into account:

1.Net Operating Income (NOI): The first and most critical factor in the cap rate calculation is the property’s Net Operating Income. NOI is calculated by subtracting all operating expenses from the total rental income. Operating expenses include property taxes, insurance, maintenance, property management fees, utilities, and other costs associated with running the multifamily property.

2.Market Cap Rate: The cap rate is a relative metric, and it’s important to consider the prevailing cap rates in the market where the multifamily property is located. The market cap rate serves as a benchmark, and it reflects the risk associated with investing in that particular market. Cap rates can vary significantly from one market to another and change over time due to market conditions.

3.Risk and Location: Cap rates also account for the perceived risk associated with the property’s location and market conditions. Properties in more stable and desirable areas may have lower cap rates, while properties in riskier or less desirable locations may have higher cap rates to compensate for the added risk.

4.Property-Specific Factors: The condition and quality of the multifamily property, as well as its age and amenities, can influence the cap rate. Well-maintained, newer properties with attractive amenities may command lower cap rates, reflecting higher investor confidence in the asset.

5.Tenant Leases: The terms and stability of tenant leases play a role in cap rate calculations. Longer-term leases with reliable tenants can result in a lower perceived risk, potentially leading to a lower cap rate.

6.Vacancy Rate: The expected or historical vacancy rate is factored into the cap rate calculation. A higher vacancy rate can lead to a higher cap rate because it suggests greater income uncertainty.

7.Growth and Rent Projections: Projections for rental income growth and potential rent increases may be considered in the cap rate calculation. The expectation of rental income growth could lead to a lower cap rate.

The formula for calculating the cap rate is as follows:

Cap Rate = NOI / Property Value

Or, rearranged:

Property Value = NOI / Cap Rate

In summary, the cap rate calculation for multifamily assets considers factors such as the property’s Net Operating Income, market cap rates, location-specific risk, property-specific characteristics, tenant leases, vacancy rates, and income growth projections. These factors are combined to determine the appropriate cap rate, which is then used to estimate the property’s value based on its income-generating potential within its market.

Yes, non-US investors can invest in real estate syndications in the United States. However, there are certain considerations and regulations they must be aware of when making such investments:

1.Regulatory Requirements: Non-US investors need to understand and comply with the regulations set by the U.S. Securities and Exchange Commission (SEC) regarding investments made by non-US individuals or entities. These regulations may include specific restrictions or requirements for non-US investors participating in syndications.

2.Tax Implications: Non-US investors should be aware of the tax implications of investing in U.S. real estate syndications. They may be subject to different tax treatments, including withholding taxes on income generated from their investments. Understanding the tax treaties between the US and the investor’s home country is essential.

3.Documentation and Legal Considerations: Non-US investors need to review and understand the legal documentation associated with the real estate syndication, including the operating agreements, subscription agreements, and other relevant legal documents. It is advisable for non-US investors to seek legal advice from professionals with expertise in cross-border investments and U.S. real estate transactions.

4.Foreign Exchange Risk: Non-US investors should consider the potential impact of foreign exchange fluctuations on their investments in U.S. real estate syndications. Any returns or income generated in U.S. dollars may be subject to changes in currency exchange rates, which can affect the overall investment return.

5.Compliance with Anti-Money Laundering (AML) Regulations: Syndication sponsors may have anti-money laundering compliance requirements that non-US investors must meet before they can invest. These requirements are in place to prevent money laundering and the financing of illegal activities.

These videos can explain in detail –